Amid the uncertainty of 2020 and into 2021, leaders in all industries are taking a close look at their revenues, costs, and cash flow. These considerations are important and sometimes urgent, especially in the past year or so.

One approach is to focus primarily on cash flow. A cash flow focus alone won’t always get to the root of the issue, or it could lead to missed opportunities. As you continue to look to the future, consider taking another step by considering how program revenues and costs contribute to the organization’s overall success. Analyzing program profitability helps you understand your current reality and make strategic decisions and changes.

Even though the nonprofit’s main focus is on the mission and not generating profits, a successful nonprofit will generate positive changes in net assets and positive cash flow in most years. Your organization’s programs each have a contribution to the mission and your bottom line. You might intuitively have a feel for each program’s profitability, but the results of the program profitability calculation could surprise you. In addition, formalizing the calculations and documenting each program’s net financial effect will provide information to other decision-makers who often have different and important perspectives.

To calculate program profitability:

Step 1 – Evaluate the impact each program makes on your overall mission. To keep it simple, you could divide the programs into high and low mission alignment.

Step 2 – Calculate the contribution margin for each program. Some programs will always have a deficit and must be funded by other programs or by contributions. To calculate contribution margin, accumulate the revenue and expenses for each program. Many organizations already track individual programs within their accounting software. If yours does, review the assumptions used to make allocations to ensure they are accurate. Sometimes allocations could be outdated if programs have undergone changes. If tracking is not done on a program basis, going through the exercise of allocating expenses will be necessary. This can be very detailed or done at a high level, but accuracy and consistency are important. An accurate program profitability calculation yields a strong basis for evaluating your programs.

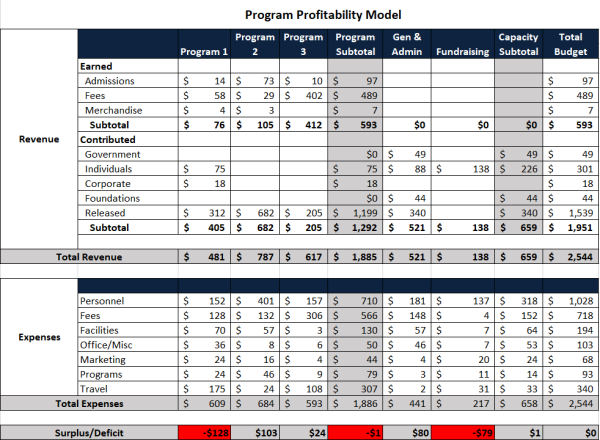

Your calculation might look something like this (Nonprofit Finance Fund has a great article on this topic, and we adapted the following model from their example):

Step 3 – Match up your mission evaluation with the program profitability.

- High $ Contribution

- High mission Alignment = Clear winners, but rare. These programs often compete with for-profit enterprises. It should be a priority to cultivate and preserve these programs.

- Low mission Alignment = These programs are not aligned to your mission, but they are likely important for financing other programs. Are the “non-financial” costs high?

- Low $ Contribution

- High mission Alignment = Closely linked to the mission but have to be sustained by other programs. These could be your largest programs. Often these programs are also sustained by contributions not restricted by donors. Looking for ways to improve the bottom line will make the organization less reliant on donations that could vary depending on donor’s economic climate and priorities.

- Low mission Alignment = Legacy programs that have evolved over time or programs that previously made a high contribution. Is it worth it to try to improve them to be positive contributors? Soliciting donors for low-mission aligned programs is generally not an option, so operational changes would be needed. There are often opportunities to phase out these unprofitable programs.

Sometimes going through this exercise with a third-party is helpful to accomplish your goals and help avoid bias. The idea is simple, but the process takes time and careful consideration. Once you have the framework in place, you can re-use it and adjust as needed to continuously evaluate your profitability. At TDT, we’re available to help guide you through this process if it seems daunting or you’re not sure where to start.

Once the calculation is in place, critically evaluate the programs in coordination with the various stakeholders. Develop strategies to make the changes necessary to propel your organization to achieving the mission and improving your financial position.

ABOUT THE AUTHOR

Ross Van Laar

Relevant Posts

Learn What Your Business Needs Most to Unlock Faster Growth

Your business relies on four key areas, or centers of intelligence, to thrive. Take the free Business Intelligence Grader to see how you score across financial, leadership, productivity, and human intelligence and learn where to focus to drive greater results.

Your business relies on four key areas, or centers of intelligence, to thrive. Take the free Business Intelligence Grader to see how you score across financial, leadership, productivity, and human intelligence and learn where to focus to drive greater results.